Footprint & Milestones

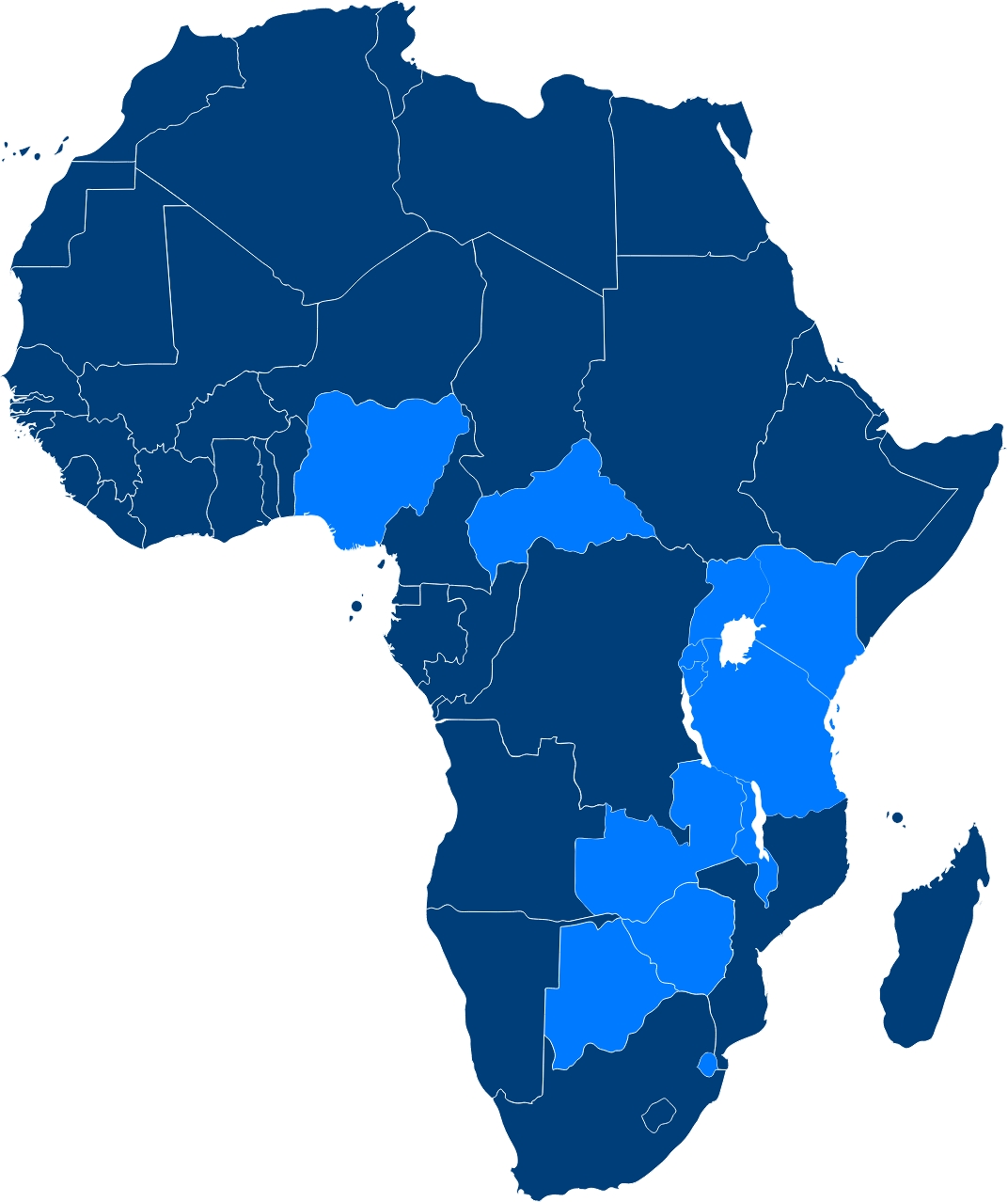

We have operations and partnerships in East and Southern Africa and we are currently making progressive inroads into West Africa. It is our desire to take an active part in the growth and transformation of business in Africa and we aim to take solutions from Africa to the world.

.

Coverage

We have worked across many African countries including Botswana, Kenya, Malawi, Nigeria, Rwanda, Tanzania, Uganda, Zambia, Zimbabwe and Eswatini

|

- Escrow Systems provided the technical solution to the Government of Kenya working with CDSC Kenya; Central Bank of Kenya; Nairobi Securities Exchange and Mobile Network Operators in the mobile traded retail bond, dubbed M-Akiba. This retail bond, the first of its kind in the world was a resounding success and the Escrow technology was a key factor.

- Escrow supplied the Initial Public Offer System which was used in the self-listing of the Nairobi Stock Exchange (NSE) which enabled NSE to list on its own Exchange and raise capital for further expansion.

- Our systems have been deployed to a number of leading Share Registry firms in Kenya who collectively manage more that 50% of the companies listed on the Nairobi Stock Exchange. These systems are responsible for the share register management, IPO’s, dividends processing and reconciliations and several other corporate actions.

- Escrow Systems having been contracted by Eswathini Stock Exchange, automated the entire Kingdom of Eswathini capital market by providing the Automated Trading System connecting all capital market participants and integrating directly with the Central Depository System at Eswathini Central Bank. Although our solution came complete with a closely-coupled CSD, Eswathini Stock Exchange requested us to integrate with the one already installed at their Central Bank since it had excess capacity. We also provided a Surveillance module to give the Capital Markets regulator view access to the market trades with the capability to monitor participants and intervene by halting trade in cases of violations.

- We also provided a fully-fledged SACCO management System complete with in-build accounting module to Green Pastures SACCO, one of the largest and vibrant SACCO’s in the Kingdom of Eswathini..

In Uganda, the Escrow Group deployed and implemented the Central Depository System for AltX, the first alternative stock exchange in Uganda.

In Tanzania, the Escrow Group provides various technologies including workflow management systems; share registry management systems; IPO systems; and online investor management systems.

The Escrow Group implemented a web platform for users to access shareholder information from the web & mobile. The platform was first adopted in 2010 by C&R Registrars in Kenya & subsequently by Centurion Registrars in Nigeria, Corpserve Zimbabwe & Corpserve Zambia.

In Rwanda, the Escrow Group provided the IPO system employed by CDSC Kenya for the Bank of Kigali IPO & other transactions.

In Zambia, the Escrow Group operates a securities registry firm on the Lusaka Stock Exchange.

In Botswana, the Escrow Group provides Share Registry Technology to an operator on the Botswana Stock Exchange.

We have provided share registry systems to Share Registrars and Banks in Malawi and Tanzania for the management of various listed counters trading on the Malawi Stock Exchange and the Dar es Salam Stock Exchange. Our systems in these territories continue hogging the limelight due to their flexibility, scalability and diversity.

Achievements

Escrow Systems automated the Eswatini (Swaziland Stock Exchange) and deployed its mobile trading platform C-TRADE; in the process integrating the entire capital markets.

Launched C-TRADE the first online and mobile platform of its kind in Africa. This opened real- time capital markets access to all citizens living in and out of the country.

Escrow provided the technology for the Government of Kenya mobile traded retail bond dubbed M-Akiba; the first mobile traded retail bond in the world.

The Escrow Group established the Financial Securities Exchange FINSEC) the first (Alternative Trading Platform) and the only second licensed securities exchange in Zimbabwe.

Escrow provided the technology platform for the Initial Public Offer and self-listing of the Nairobi Securities Exchange.

Escrow deployed securities registry systems to 3 banks in Malawi and one in Tanzania.

In Tanzania, Escrow was the Data Processing Consultant in the TBL second IPO in 2012.

In Rwanda, the Escrow Group provided the IPO system employed by CDSC Kenya for the Bank of Kigali IPO

Africa, The Escrow Group implemented a web platform for users to access shareholder information from the web

Clients and Partners

We have been privileged to serve and partner some of the leading companies in the financial services industry across Africa. We endeavor to continue adding value to every interaction we have with our valued stakeholders. Some of the business organisations that enjoy the benefits of our wide product range and unparalleled service delivery include the following:

Chairman

Chairman